Iowa Homestead Tax Credit

Monday, June 10, 2019

Iowa Homestead Tax Credit filing deadline is fast approaching!

New homeowners in Iowa are encouraged at the closing table to file for the Iowa Homestead Tax Credit as soon as possible. This program was originally adopted by the state to encourage home ownership through property tax relief. It also protects the homeowner from certain debts being attached to their property as a lien. Homeowners are eligible for the exemption if they own and occupy the property as their primary residence and if they declare residency in Iowa for income tax purposes. They must also occupy the property for a minimum of 6 months annually. Owners in the military or nursing homes who do not occupy the home are also eligible.

The current credit is equal to the actual tax levy on the first $4,850 of actual value which translates to an average of $50-$200 savings per year on property taxes.

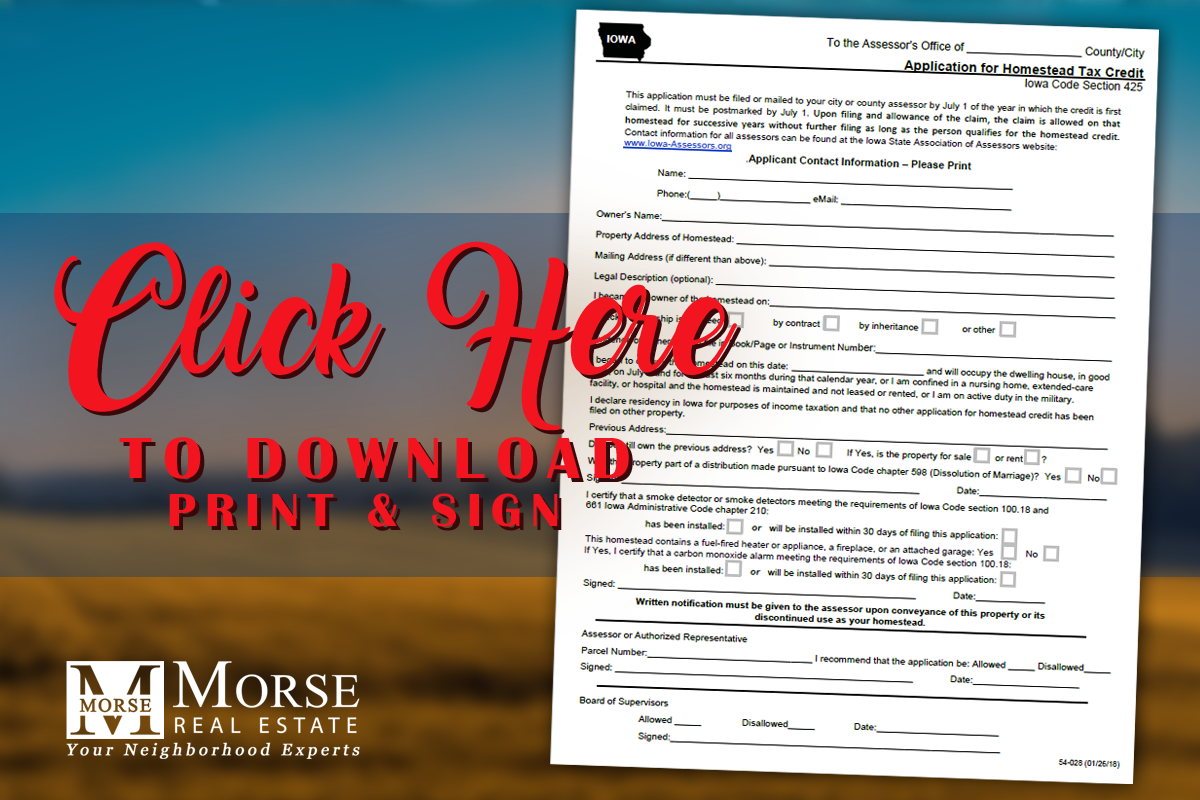

Homeowners that would like to file for this exemption may fill out this form and submit it to the county prior to July 1 and only have to file once during a lifetime of ownership as long as it continues to qualify or the property is sold or transferred. People signing up will also be required to certify that a smoke detector has been, or will be installed in the home.

Pottawattamie county homeowners may submit the forms:

Stopping by in person:

Pottawattamie County Assessor

227 S 6th St. Ste 257

Council Bluffs, IA

Mailing it in:

Pottawattamie County Assessor

PO Box 1076

Council Bluffs, IA 51502

E-mailing it to:

If you have questions about filing or would like to speak to one of our expert agents, send us a message!